Maximizing Your Retirement Dreams: A Deep Dive Into Principal 401k Plans

Let’s get real, folks. Retirement planning ain’t just some buzzword for the distant future—it’s a crucial piece of your financial puzzle. And if you’re diving into the world of employer-sponsored retirement plans, the Principal 401k is a game-changer. Think of it like a financial safety net that helps you build wealth over time while enjoying tax advantages. But here’s the thing: not everyone knows how to make the most out of it. So, buckle up, because we’re about to break it down for you.

Now, I know what you’re thinking—“Retirement? That’s decades away!” But trust me, the earlier you start, the better. Compound interest is like a magical force that works in your favor when you give it time. And hey, if you’re already enrolled in a Principal 401k, congrats! You’re on the right track. But are you maximizing it? Are you contributing enough? Are you invested in the right funds? These are questions we’re going to tackle today.

Whether you’re a newbie trying to understand the basics or a seasoned investor looking to fine-tune your strategy, this article’s got you covered. We’ll dive deep into Principal 401k plans, their benefits, how to optimize them, and everything in between. So, let’s get started, shall we?

What Exactly is a Principal 401k?

First things first, let’s talk about what a Principal 401k actually is. Simply put, it’s a type of employer-sponsored retirement savings plan offered by Principal Financial Group. It’s like a partnership between you and your employer to save for your golden years. The cool part? Contributions are made pre-tax, which means you’re reducing your taxable income right off the bat. Plus, many employers offer matching contributions, which is basically free money!

Here’s the deal: a 401k plan is designed to help you save for retirement while enjoying some sweet tax benefits. Your contributions grow tax-deferred, meaning you don’t pay taxes on the gains until you withdraw the money. And if you withdraw after age 59½, you’ll only pay taxes on the amount you take out. It’s like a financial win-win!

How Does Principal 401k Work?

Now that we’ve covered the basics, let’s dive into the nitty-gritty of how Principal 401k works. First off, you’ll need to enroll in the plan through your employer. Once you’re enrolled, you can start contributing a percentage of your salary. Your employer will then deduct the amount from your paycheck and deposit it into your account.

Here’s where it gets interesting: you can choose how to invest your contributions. Principal offers a wide range of investment options, including mutual funds, target-date funds, and even individual stocks. The key is to diversify your portfolio to manage risk while maximizing returns. And don’t forget—many employers match a portion of your contributions, so make sure you’re contributing enough to take full advantage of that free money!

Why Choose Principal 401k Over Other Plans?

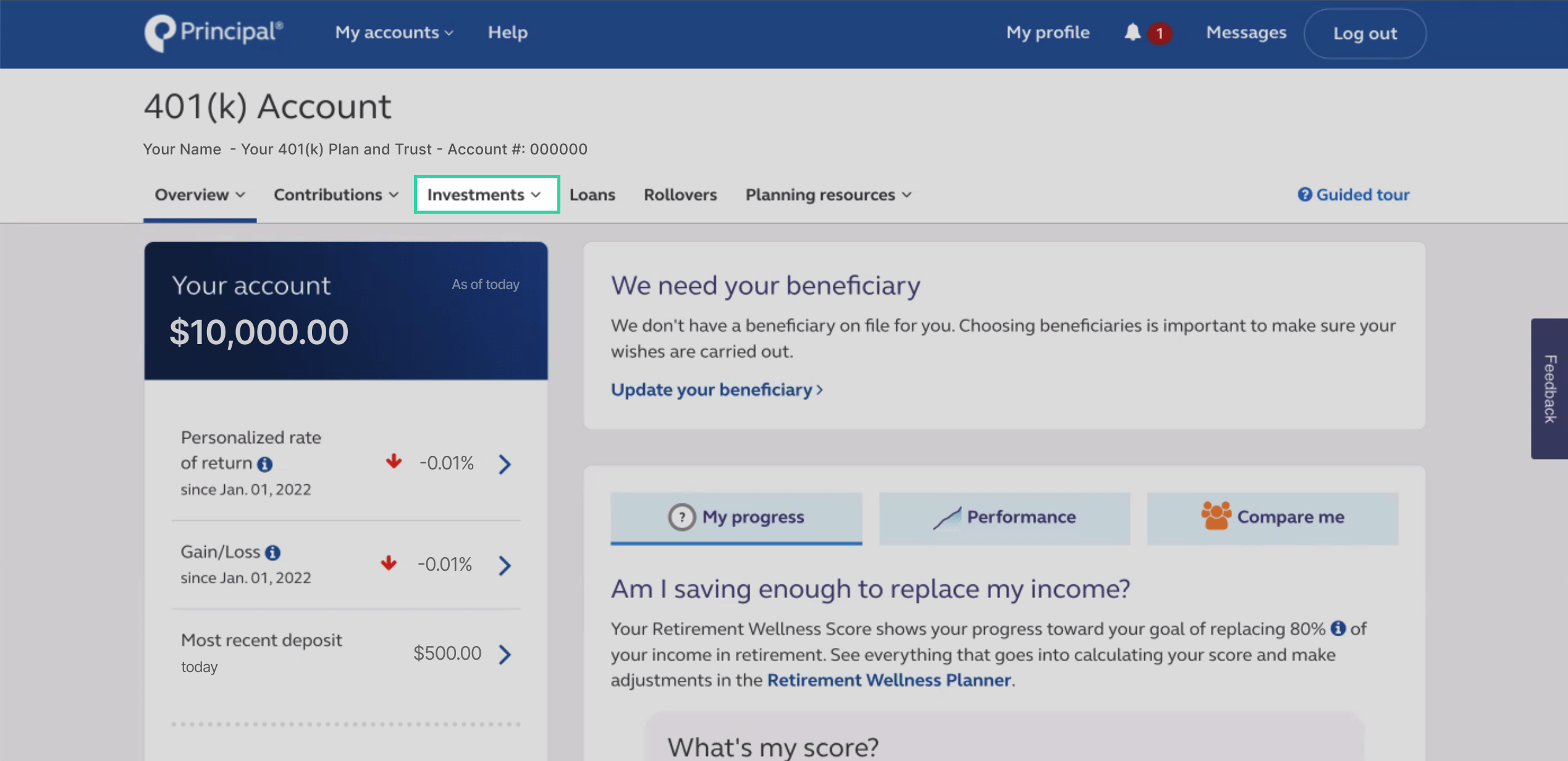

So, why should you choose Principal 401k over other retirement plans? Well, for starters, Principal Financial Group is a well-established financial institution with a solid reputation. They offer a wide range of investment options, competitive fees, and excellent customer service. Plus, their online platform makes it easy to manage your account and track your progress.

But that’s not all. Principal also offers educational resources to help you make informed decisions about your retirement savings. From webinars to one-on-one consultations, they’ve got your back. And let’s not forget about their mobile app, which allows you to manage your account on the go. Convenience at its finest!

Benefits of Principal 401k

Let’s talk about the benefits of Principal 401k. First and foremost, it’s a tax-advantaged retirement savings plan. Contributions are made pre-tax, which reduces your taxable income. And since the money grows tax-deferred, you don’t have to worry about paying taxes on the gains until you withdraw the money.

Another major benefit is the employer match. If your employer offers a match, it’s like getting a bonus just for saving for your future. And let’s not forget about the convenience factor. With Principal’s online platform and mobile app, managing your account has never been easier.

How to Maximize Your Principal 401k Contributions

Now that you know the benefits, let’s talk about how to maximize your contributions. First, make sure you’re contributing enough to get the full employer match. This is free money, folks, so don’t leave it on the table! Next, consider increasing your contributions over time. Even a small increase can make a big difference in the long run.

Here are some tips to help you maximize your contributions:

- Set a goal to increase your contributions by 1% each year.

- Consider contributing a percentage of any raises or bonuses you receive.

- Automate your contributions to make it easier to stick to your savings plan.

- Review your investment options regularly to ensure they align with your goals.

Investment Options in Principal 401k

When it comes to investing your contributions, Principal offers a wide range of options. From mutual funds to target-date funds, there’s something for everyone. Here’s a quick breakdown of the most popular options:

- Target-Date Funds: These are designed to automatically adjust your asset allocation as you approach retirement. They’re a great option if you want a hands-off approach.

- Mutual Funds: These allow you to invest in a diversified portfolio of stocks and bonds. They’re a good choice if you want more control over your investments.

- Index Funds: These track a specific index, such as the S&P 500. They’re known for their low fees and consistent performance.

Remember, the key to successful investing is diversification. Don’t put all your eggs in one basket. Spread your investments across different asset classes to manage risk while maximizing returns.

Understanding the Fees in Principal 401k

Let’s talk about fees. No one likes fees, but they’re a necessary evil when it comes to retirement savings plans. Principal 401k plans typically have two types of fees: administrative fees and investment fees. Administrative fees cover the cost of managing the plan, while investment fees cover the cost of managing your investments.

The good news is that Principal is known for its competitive fees. They offer a fee disclosure statement that breaks down all the fees associated with your plan. This makes it easy to understand exactly what you’re paying for. And if you’re not happy with the fees, you can always talk to your employer about negotiating better terms.

How to Minimize Fees

Now, let’s talk about how to minimize fees. First, choose low-cost investment options, such as index funds. These typically have lower expense ratios than actively managed funds. Next, consider consolidating your accounts. If you have multiple 401k plans from previous employers, rolling them over into your current plan can help reduce fees.

And don’t forget to review your fee disclosure statement regularly. If you notice any fees that seem excessive, talk to your employer or a financial advisor. They can help you find ways to reduce your costs without sacrificing performance.

Common Mistakes to Avoid with Principal 401k

Now that we’ve covered the basics, let’s talk about some common mistakes to avoid. One of the biggest mistakes people make is not contributing enough to get the full employer match. Remember, this is free money! Another common mistake is not diversifying your investments. Putting all your money into one fund or asset class can be risky.

Here are some other mistakes to watch out for:

- Withdrawing money early. Not only will you pay taxes on the withdrawal, but you’ll also face a 10% penalty if you’re under age 59½.

- Ignoring your account. Regularly reviewing your investments and making adjustments as needed is crucial to staying on track.

- Not increasing your contributions over time. Even a small increase can make a big difference in the long run.

How to Stay on Track with Your Retirement Goals

Staying on track with your retirement goals requires a combination of discipline and strategy. First, set clear goals and create a plan to achieve them. This might include increasing your contributions, diversifying your investments, and regularly reviewing your progress.

Next, consider working with a financial advisor. They can help you create a personalized plan based on your unique circumstances and goals. And don’t forget to take advantage of Principal’s educational resources. From webinars to one-on-one consultations, they’ve got everything you need to succeed.

Is Principal 401k Right for You?

So, is Principal 401k right for you? The answer depends on your individual circumstances and goals. If you’re looking for a well-established financial institution with a wide range of investment options and competitive fees, then Principal might be a great fit. But if you’re not happy with the available options or fees, it might be worth exploring other plans.

Here’s a quick checklist to help you decide:

- Does your employer offer a match?

- Are the fees reasonable?

- Are the investment options aligned with your goals?

- Do you have access to educational resources and support?

Final Thoughts

Retirement planning can seem overwhelming, but with the right tools and strategies, it doesn’t have to be. Principal 401k plans offer a tax-advantaged way to save for your future while enjoying some sweet benefits like employer matches and low fees. By maximizing your contributions, diversifying your investments, and avoiding common mistakes, you can set yourself up for success.

So, what are you waiting for? Take control of your financial future today. Enroll in your Principal 401k, review your investment options, and start saving for the retirement of your dreams. And don’t forget to share this article with your friends and family. Knowledge is power, folks!

Conclusion

As we wrap up, let’s recap the key points we’ve covered. Principal 401k plans offer a tax-advantaged way to save for retirement while enjoying benefits like employer matches and low fees. To make the most of your plan, maximize your contributions, diversify your investments, and avoid common mistakes. And if you ever feel unsure, don’t hesitate to seek help from a financial advisor or Principal’s educational resources.

Now, it’s your turn to take action. Enroll in your Principal 401k, review your investment options, and start saving for the retirement of your dreams. And remember, the earlier you start, the better. So, what are you waiting for? Your future self will thank you for it!

Table of Contents

- Maximizing Your Retirement Dreams: A Deep Dive Into Principal 401k Plans

- What Exactly is a Principal 401k?

- How Does Principal 401k Work?

- Why Choose Principal 401k Over Other Plans?

- Benefits of Principal 401k

- How to Maximize Your Principal 401k Contributions

- Investment Options in Principal 401k

- Understanding the Fees in Principal 401k

- How to Minimize Fees

- Common Mistakes to Avoid with Principal 401k

- How to Stay on Track with Your Retirement Goals

- Is Principal 401k Right for You?

- Final Thoughts

- Conclusion

Principal Financial Group 401k A Path to Secure Retirement Business

How to make changes to your Principal 401(k) portfolio Capitalize

Principal Financial Group Logo Png