Lloyd's Of London: The World's Unique Insurance Powerhouse

Explore Lloyd's of London, a name synonymous with global insurance innovation and resilience. Far from being a conventional insurance company, Lloyd's stands as an unparalleled marketplace, a vibrant hub where complex risks meet sophisticated solutions. It's a unique ecosystem that has shaped the landscape of international insurance for centuries, providing specialist services to businesses in over 200 countries and territories.

This esteemed institution, often simply referred to as Lloyd's, represents a cornerstone of the global financial sector. Its distinctive structure, rich history, and unwavering commitment to managing the world's most intricate risks make it a fascinating subject. From insuring satellites to iconic celebrity body parts, Lloyd's of London has consistently demonstrated its capacity to adapt, innovate, and provide critical financial security in an ever-evolving world.

Table of Contents

- What Exactly is Lloyd's of London?

- A Deep Dive into Lloyd's Historical Roots

- The Unique Structure of the Lloyd's Market

- Lloyd's Global Reach and Impact

- Insuring the Uninsurable: Lloyd's Expertise in Unique Risks

- Financial Strength and Stability of Lloyd's

- Modern Initiatives and Future Vision

- Why Lloyd's Matters for Your Business and Beyond

What Exactly is Lloyd's of London?

When you hear the name "Lloyd's of London," you might instinctively think of an insurance company. However, this is a common misconception that needs immediate clarification. Unlike traditional insurance companies that directly underwrite policies, Lloyd's is, in essence, a marketplace. It is an exclusive insurance marketplace that brings together various stakeholders in the industry, such as underwriters, brokers, managing agents, and coverholders. It acts as a facilitator for insurance transactions, connecting buyers and sellers of insurance and reinsurance.

Governed by the Lloyd's Act 1871 and subsequent acts of parliament, Lloyd's is a corporate body, not a single monolithic insurer. This unique structure allows it to operate as a central hub where risk is shared and managed. It provides the venue, the regulatory framework, and the financial oversight for its members to conduct their insurance business. This model fosters a dynamic environment where expertise and capital converge to offer specialist insurance services to businesses in over 200 countries and territories, making Lloyd's of London a truly global entity.

A Deep Dive into Lloyd's Historical Roots

The story of Lloyd's of London is deeply intertwined with the history of global commerce and risk management. Its origins trace back to a humble coffeehouse established by Edward Lloyd on Tower Street in London in 1688. In an era when merchants, shipowners, and sea captains gathered to exchange news and conduct business, Lloyd's coffeehouse became a popular meeting point. It was here that the earliest forms of marine insurance began to be transacted, with individuals "subscribing" their names to policies, agreeing to cover a portion of the risk of a ship or its cargo. This informal gathering gradually evolved into the structured marketplace we know today, maintaining its reputation for insuring unusual items and distinguished by its affluent members.

While its history is long and illustrious, it is also marked by periods that reflect broader societal injustices. In 2020, Lloyd's of London made a significant public apology for its historical links to the transatlantic slave trade. This acknowledgment was accompanied by a commitment to make an honest account of its past a part of the story it tells. Lloyd's has since undertaken several pieces of research, including an independent research collaboration, to understand and contextualize its historical involvement. This demonstrates a commitment to transparency and confronting difficult aspects of its heritage, reinforcing its trustworthiness in the modern era.

The Unique Structure of the Lloyd's Market

What truly sets Lloyd's of London apart is its distinctive operating model, often referred to as a "subscription market." In this system, rather than a single insurer taking on an entire risk, multiple underwriters (members of Lloyd's) can each take a portion of a larger policy. This shared risk approach is a fundamental pillar of Lloyd's, enabling it to underwrite exceptionally large or complex risks that no single company might be willing or able to cover alone. This collaborative model fosters diversification, expertise, flexibility, stability, and global reach for institutional investors and policyholders alike.

The marketplace brings together several key players, each with a crucial role in the risk transfer process. Understanding these roles is essential to grasping how Lloyd's functions as a global insurance hub. These stakeholders include Syndicates, Brokers, Managing Agents, and Coverholders, all operating within the unique framework provided by Lloyd's of London.

The Role of Syndicates

At the heart of the Lloyd's market are the syndicates. These are groups of members, comprising both companies and individuals (historically known as "Names"), who come together to underwrite insurance for their own account and risk. Each syndicate specializes in various types of risks, from property and casualty to marine, aviation, and even highly unusual or bespoke policies. These syndicates are the capital providers and risk-takers within the market. They are managed by managing agents, who oversee their underwriting activities, manage their capital, and ensure compliance with Lloyd's regulations. The syndicates' ability to pool resources and specialize allows Lloyd's to offer comprehensive coverage for a vast array of global risks, making Lloyd's of London a go-to for complex insurance needs.

The Vital Function of Brokers

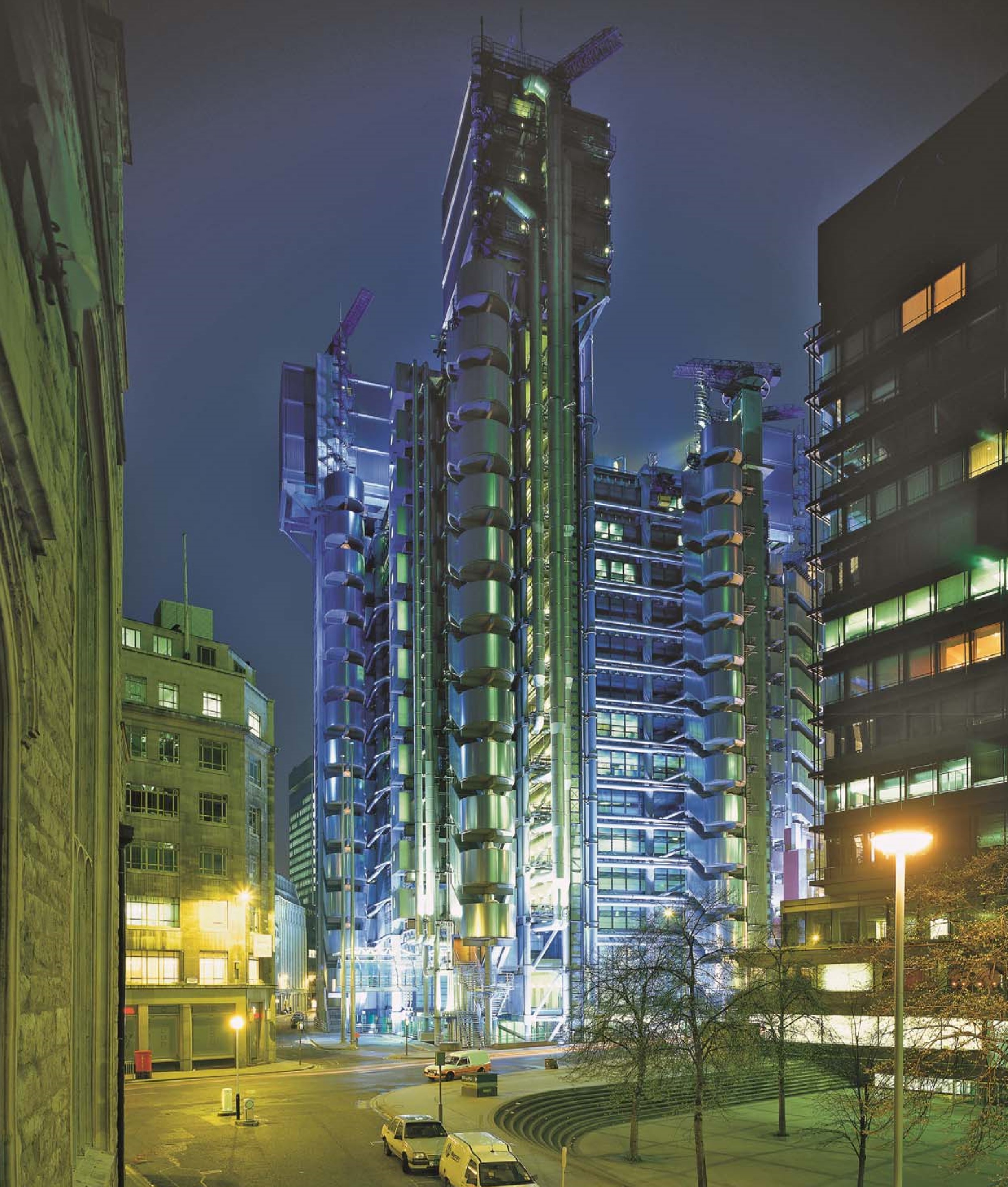

In the Lloyd's market, brokers play an absolutely crucial role. Lloyd's is fundamentally a broker market, where strong relationships, backed by deep expertise, are paramount. Brokers act as intermediaries, facilitating the risk transfer process between policyholders (insurance buyers) and underwriters (the syndicates). Much of this business involves face-to-face negotiations between brokers and underwriters, often taking place on the famous underwriting floor at Lloyd's building in London. These brokers possess specialized knowledge of the market, helping clients navigate the complexities of securing coverage for unique or challenging risks. As of 31 December 2022, there were 384 registered brokers at Lloyd's, highlighting their significant presence and the importance of their role in connecting global clients with the specialized capacity available within Lloyd's of London.

Lloyd's Global Reach and Impact

Lloyd's of London is not merely a local institution; it is a truly global powerhouse in the insurance and reinsurance world. It is the world's leading insurance market, providing specialist insurance services to businesses in over 200 countries and territories. This extensive reach means that wherever there is a significant risk to be managed, from emerging markets to established economies, Lloyd's underwriters are often involved.

A prime example of its international influence is its long-standing presence in the United States. Lloyd's of London has been a major force in the US insurance market for over a century. Throughout this long relationship, Lloyd's underwriters have provided people, businesses, and communities in the US with creative risk management solutions and helped them recover in times of need. Its offices, events, tools, resources, and diversity and inclusion initiatives in the US underscore its deep commitment to this vital market. Lloyd's ability to offer reinsurance capacity and innovative solutions has made it an indispensable partner for businesses and other insurers looking to manage complex and catastrophic risks across the globe.

Insuring the Uninsurable: Lloyd's Expertise in Unique Risks

One of the most enduring popular perceptions of Lloyd's of London is its reputation for insuring the unusual, the extraordinary, and what might seem, at first glance, uninsurable. While this aspect often captures public imagination – think celebrity body parts, space missions, or even lottery winnings – it speaks to a much deeper truth about Lloyd's core competency: its unparalleled expertise in anticipating, understanding, and developing innovative solutions for complex and emerging risks. This is where the market truly shines, providing the leadership and insight necessary to navigate an increasingly complex global landscape.

The Lloyd's market is renowned for its ability to craft bespoke policies for risks that don't fit into standard categories. This involves a deep understanding of niche industries, cutting-edge technologies, and evolving global threats. The collaborative nature of the subscription market allows syndicates to pool their specialized knowledge and capital, enabling them to assess and underwrite risks that might be too novel or too large for a single insurer. This commitment to innovation means that Lloyd's of London continues to develop relevant, new, and innovative forms of insurance for customers globally, helping people and businesses build confidence and resilience in a world full of uncertainties.

Financial Strength and Stability of Lloyd's

The ability of Lloyd's of London to underwrite vast and complex risks hinges on its robust financial strength and stability. While it is not an insurance company itself, the collective financial strength of its members, coupled with a rigorous regulatory framework, provides immense security to policyholders. Lloyd's maintains a strong reputation for its shared risk approach, its global reach, and its financial strength, which is underpinned by a central fund that can be called upon in the event of major claims that exceed a syndicate's individual capacity.

This financial resilience is crucial, especially when dealing with catastrophic events or large-scale liabilities. For institutional investors, Lloyd's offers diversification, expertise, flexibility, stability, and global reach, making it an attractive proposition for those looking to participate in the insurance market. The market's performance metrics further underscore its strength. For instance, total Gross Written Premium (GWP) increased in recent periods, driven primarily by volume expansion in property lines, indicating a healthy and growing market. This continuous growth and strong financial footing ensure that Lloyd's of London remains a reliable partner for risk management worldwide, capable of honoring its commitments even in the face of significant challenges.

Modern Initiatives and Future Vision

In an era of rapid global change, Lloyd's of London is not resting on its historical laurels. It is actively engaged in modern initiatives aimed at shaping the future of insurance and fostering a more inclusive and resilient industry. These efforts demonstrate a forward-thinking approach, ensuring that Lloyd's remains relevant and effective in addressing the evolving needs of its global clientele. The commitment extends beyond mere financial transactions, touching upon crucial societal aspects.

Embracing Diversity and Inclusion

Recognizing the importance of a diverse and inclusive workforce, Lloyd's has made significant strides in this area. It actively promotes diversity and inclusion initiatives across its operations, including its US offices, events, tools, and resources. This commitment is not just about social responsibility; it's also about fostering a more innovative and effective marketplace. A diverse range of perspectives brings fresh ideas, better understanding of global markets, and more creative solutions to complex risk challenges. By championing diversity, Lloyd's of London aims to build a more equitable and representative environment for all its stakeholders.

Innovation in a Complex Landscape

The world is constantly facing new and emerging risks, from cyber threats and climate change to geopolitical instability and pandemics. Lloyd's of London understands that staying ahead requires continuous innovation. The Lloyd's market provides the leadership and insight to anticipate and understand these risks, and the knowledge to develop relevant, new, and innovative forms of insurance for customers globally. This proactive approach involves leveraging data analytics, fostering technological advancements, and encouraging collaboration among market participants to devise solutions for risks that were unimaginable just a few decades ago. Together, the market is sharing risk to create a braver world, providing the confidence and resilience people and businesses need in an increasingly complex landscape.

Why Lloyd's Matters for Your Business and Beyond

In summary, Lloyd's of London is far more than just a name in the insurance world; it is a vital global institution that plays a critical role in managing risk and fostering economic stability. Its unique marketplace structure, where syndicates and brokers collaborate to underwrite diverse risks, offers unparalleled flexibility and expertise. From its historical roots in a London coffeehouse to its modern commitment to innovation and diversity, Lloyd's has consistently adapted to meet the evolving needs of a complex world.

For businesses, institutions, and even individuals facing unique or substantial risks, Lloyd's of London provides access to a depth of underwriting capacity and specialist knowledge that is unmatched. It is where creative risk management solutions are born, and where resilience is built in the face of uncertainty. Its global reach ensures that this expertise is accessible across continents, helping communities and economies recover from unforeseen events. Understanding Lloyd's is to understand a fundamental pillar of global financial security.

What are your thoughts on the unique structure of Lloyd's? Have you ever encountered an unusual insurance policy that might have originated from this market? Share your insights in the comments below, or explore other articles on our site to deepen your understanding of the fascinating world of global finance and risk management!

Lloyd's of London - Designing Buildings Wiki

London - Lloyds of London — embArch

Lessons learnt as Lloyd’s of London prepares to leave iconic HQ