Unlock Savings: Progressive Snapshot For Smart Drivers

Table of Contents

- What is Progressive Snapshot? Driving Towards Personalized Rates

- How Progressive Snapshot Tracks Your Driving Habits

- The Benefits of Progressive Snapshot: Rewarding Safe Driving

- Potential Downsides and Risks: Is Progressive Snapshot for Everyone?

- Maximizing Your Progressive Snapshot Discount

- Progressive Snapshot vs. Other Telematics Programs

- Getting Started with Progressive Snapshot: Eligibility and Enrollment

- Real-World Experiences with Progressive Snapshot

In the evolving landscape of car insurance, traditional factors like age, driving history, and vehicle type are no longer the sole determinants of your premium. Insurers are increasingly leveraging technology to offer more personalized rates, and one prominent example is Progressive Snapshot. This innovative program aims to reward you for good driving by personalizing your car insurance rate based on your actual driving habits, offering a compelling way to potentially save money on your policy.

As car insurance costs continue to be a significant expense for many, understanding programs like Progressive Snapshot becomes crucial. It represents a shift towards a more dynamic pricing model, where your real-time behavior behind the wheel can directly influence what you pay. But how exactly does this telematics tool work, what are its benefits, and are there any downsides to consider before you opt-in? This comprehensive guide will delve deep into the Progressive Snapshot program, helping you decide if it's the right fit for your driving style and financial goals, especially as we look towards 2025 and beyond.

What is Progressive Snapshot? Driving Towards Personalized Rates

Progressive Snapshot is a car insurance program designed to reward drivers who exhibit safe driving behaviors with policy discounts. At its core, it's a telematics tool that collects data about how you drive, rather than just relying on your past record or demographic information. The idea is simple: if you drive less, in safer ways, and during safer times of day, you should be eligible for a lower insurance rate. This personalized approach moves beyond the one-size-fits-all model, offering a more equitable pricing structure for responsible drivers.

Instead of basing your rate solely on factors such as your driving history or age, Snapshot Road Test gives you a personalized discount that's based on your driving habits. This means that even if you have a few minor infractions from years ago, your current safe driving can still earn you significant savings. Progressive Snapshot aims to empower drivers to take control of their insurance costs by encouraging and rewarding good habits. Your participation in the Snapshot program is expressly conditioned on your acceptance of these terms and conditions, ensuring transparency about how your data is used to calculate your personalized discount.

How Progressive Snapshot Tracks Your Driving Habits

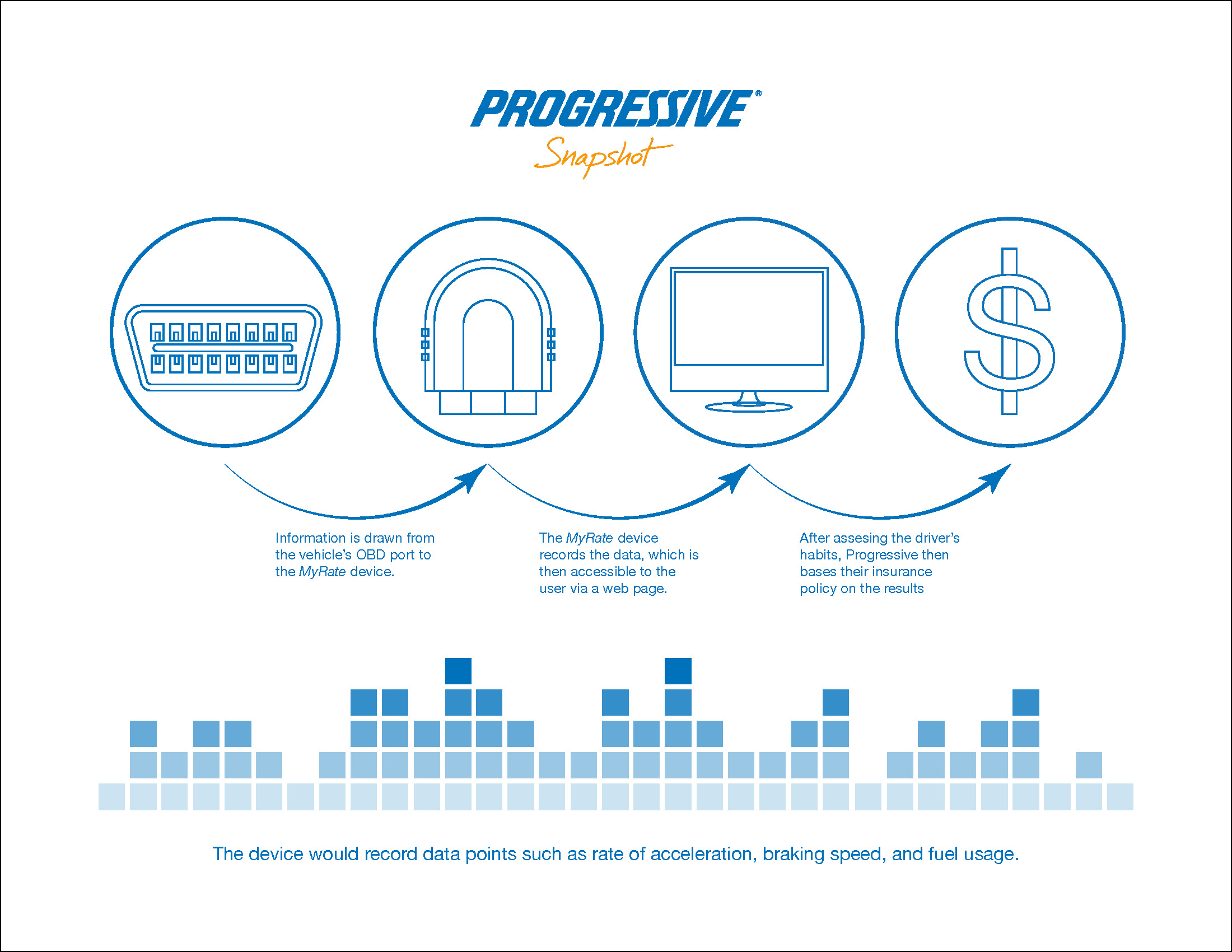

The fundamental question many drivers have is: "How does Progressive Snapshot actually track my driving?" The program utilizes telematics technology, which can be deployed in a couple of ways: through a small device that plugs into your car's OBD-II port, or via the Progressive mobile app on your smartphone. The monitoring method cannot be a mix of mobile app and device; you choose one for the duration of your participation.

With Snapshot, Progressive measures a variety of factors related to your driving. These include crucial elements such as:

- Bethenny Frankel Instagram

- Doordash Phone Number

- Keke Palmer Movies And Tv Shows

- Michelle Moyer

- Iad Airport

- Time of Day You Drive: Driving during peak hours or late at night often carries higher risks. Snapshot assesses how much you drive during these periods.

- Sudden Changes in Speed (Hard Brakes and Rapid Accelerations): These indicate aggressive or inattentive driving. Frequent hard braking or rapid acceleration can negatively impact your score.

- The Amount You Drive: Less mileage generally means less exposure to risk, and Snapshot rewards you for driving less.

- Mobile Phone Use While Driving: For customers using the mobile app in some states, the program can detect how you're using your mobile phone while driving, penalizing distracted driving.

This data is collected over a monitoring period, typically around 30-45 days, during which the program builds a profile of your driving habits. You can look at your data through a mobile app or the Progressive website, allowing you to monitor your progress and understand how your driving is being assessed. This transparency is key to helping you adjust your habits if needed to maximize your potential discount.

The Benefits of Progressive Snapshot: Rewarding Safe Driving

The primary allure of Progressive Snapshot is the potential for significant savings on your car insurance. Progressive Snapshot is a car insurance program that rewards safe driving behaviors with policy discounts. The program may discount your auto insurance rates by up to 20%, a substantial saving for many households. Snapshot rewards good drivers with a personalized discount, making it an attractive option for those confident in their driving abilities.

Beyond the direct financial benefit, there are other advantages:

- Personalized Rates: It moves away from broad generalizations, offering a rate truly reflective of your individual driving risk. This can be particularly beneficial for young drivers or those with a less-than-perfect history who have since adopted safer habits.

- Encourages Safer Driving: Knowing your driving is being monitored can naturally encourage you to be more mindful behind the wheel. This can lead to safer roads for everyone and fewer accidents.

- Transparency and Feedback: The ability to log in to make updates anytime and view your driving data through the mobile app or website provides valuable feedback. You can see exactly what behaviors are impacting your score and adjust accordingly.

- Easy Participation: The Snapshot Road Test is an easy way to find out if your good driving could save you extra money on car insurance. The setup is straightforward, whether you're plugging in a device or downloading an app.

Ultimately, Progressive Snapshot aims to create a win-win situation: drivers save money, and Progressive gets a clearer picture of individual risk, leading to more accurate pricing and potentially fewer claims.

Potential Downsides and Risks: Is Progressive Snapshot for Everyone?

While the promise of savings is enticing, it's crucial to understand that Progressive Snapshot is not without its potential downsides and risks. The most significant concern is that while it can reward good driving, it can also raise your rates if you're a bad driver. So, it's risky and not the best option for everyone.

Here are some factors to consider:

- Rate Increase Potential: Unlike some telematics programs that only offer discounts and won't increase your premium, Snapshot explicitly states that poor driving habits detected during the monitoring period could lead to a higher rate. This makes it a calculated risk.

- Privacy Concerns: While the data is used for insurance purposes, some individuals may feel uncomfortable with their driving habits being constantly monitored. The "lights are always on" mentality, implying continuous tracking, might be a deterrent for some.

- Annoying Feedback: As one user recounted, "Yep, my wife and I used Progressive when we first got married in Louisiana, and the beeps from the Snapshot device were terrible. Got to the point that every single time I would stop at highway speeds if I caught a red light (a perfectly safe action) I would tense up in anticipation of that ridiculous beeps." These auditory cues, while intended to correct behavior, can be intrusive and frustrating.

- Misinterpretation of "Safe" Driving: Sometimes, what feels like safe driving to a human might be interpreted differently by the algorithm. For instance, an emergency hard brake to avoid an accident could be flagged as a negative event.

- Mobile Phone Usage Tracking: For app users in some states, the program tracks mobile phone usage while driving. This means even using your phone for navigation or changing music could potentially impact your score, depending on the specifics of the tracking. Standard messaging rates may apply if using the app.

It's vital to weigh these potential drawbacks against the promised savings. For drivers who are consistently on the edge of their seat, anticipating a beep for a perfectly safe action, the stress might outweigh the financial benefit.

Maximizing Your Progressive Snapshot Discount

If you decide that Progressive Snapshot is worth the consideration, the next step is to understand how to maximize your potential discount. See how it works and get tips to maximize your potential discount.

Understanding the Factors

To optimize your driving for Snapshot, you need a clear understanding of the metrics it prioritizes:

- Smooth Acceleration and Braking: Avoid sudden starts and stops. Gradual acceleration and gentle braking are key. Think about anticipating traffic and lights well in advance.

- Reduced Mileage: The less you drive, the lower your risk exposure. Consider carpooling, public transport, or combining errands to reduce your overall miles.

- Driving During Safer Hours: If possible, limit driving during late-night hours (typically 12 AM to 4 AM) and rush hour, as these periods are statistically riskier.

- Minimal Phone Use: If you're using the mobile app, ensure your phone is truly hands-free and not being actively used for texting, browsing, or even extensive calls while the vehicle is in motion.

Remember, the program tracks your driving habits before awarding a discount, so consistency throughout the monitoring period is crucial.

Strategic Driving for Savings

Beyond simply being a "good" driver, there are strategic adjustments you can make:

- Plan Your Routes: Choose routes that minimize the need for sudden stops or aggressive maneuvers. Avoid congested areas if possible.

- Maintain Safe Following Distances: This gives you more time to react to traffic changes, reducing the likelihood of hard braking.

- Be Mindful of Your Habits: Use the Progressive app or website to regularly check your data. Identify patterns where you might be losing points and consciously work to improve those areas.

- Communicate with Household Drivers: If multiple drivers use the same vehicle and are part of the Snapshot program, ensure everyone understands the metrics and is committed to safe driving. One person's poor habits can impact the overall household discount.

By actively managing your driving behaviors according to Snapshot's metrics, you significantly increase your chances of earning the maximum possible discount, potentially up to 20% off your auto insurance rates.

Progressive Snapshot vs. Other Telematics Programs

Progressive Snapshot is just one of many telematics programs offered by insurance companies today. It's important to compare Snapshot with other safe driving discount programs and see how it works in different states to make an informed decision.

Device vs. App: Understanding the Monitoring Methods

One key differentiator among telematics programs is the monitoring method. Progressive Snapshot offers both a plug-in device and a mobile app. Some insurers only offer one or the other. For instance, some programs are exclusively app-based, relying on your phone's GPS and accelerometers, which can sometimes be less accurate or drain battery life. Others might only offer a device, which some drivers find cumbersome to install or deal with. The fact that Progressive offers both options provides flexibility, though it's important to remember that the monitoring method cannot be a mix of mobile app and device for a single policy.

Comparing Discounts and Features

When comparing Snapshot to competitors, consider these aspects:

- Discount Potential: While Progressive Snapshot offers up to a 20% discount, other programs might offer higher or lower percentages. Some might even offer an initial sign-up discount just for participating.

- Rate Increase Policy: This is a critical distinction. As discussed, Snapshot can raise your rates for poor driving. Many other telematics programs explicitly state that they will *not* increase your rates, only offer discounts. This "no penalty" guarantee can be a significant factor for risk-averse drivers.

- Data Collected: While many programs track similar metrics (mileage, hard braking, time of day), some might focus more heavily on specific behaviors. For example, not all programs track mobile phone usage.

- Monitoring Period: The length of the monitoring period can vary. Snapshot typically assesses over 30-45 days, while others might monitor for longer or even continuously.

- Feedback and Transparency: How easily can you access your driving data? Progressive offers a mobile app and website for this, which is a strong point. Some competitors might have less user-friendly interfaces or provide less detailed feedback.

Reading a Progressive Snapshot review for 2025, or similar reviews for competitor programs, can provide valuable insights into real-world experiences and help you gauge which program aligns best with your comfort level and driving habits.

Getting Started with Progressive Snapshot: Eligibility and Enrollment

If you're interested in exploring the potential savings with Progressive Snapshot, the enrollment process is typically straightforward. First, you'll need to be a Progressive policyholder or in the process of getting a quote. Learn how it works in your state and how to save money with Snapshot.

The steps generally involve:

- Getting a Quote: Start by getting a car insurance quote from Progressive. During this process, or after becoming a customer, you'll be offered the option to enroll in the Snapshot program.

- Choosing Your Monitoring Method: You'll select either the plug-in device or the mobile app. If you choose the device, it will be mailed to you. If you opt for the app, you'll download it from your smartphone's app store.

- Installation/Activation: For the device, you simply plug it into your vehicle's OBD-II port, usually located under the dashboard. For the app, you'll activate it by logging in with your Progressive credentials and granting necessary permissions for location and motion sensing.

- Driving and Monitoring: Once activated, the program begins collecting data on your driving habits over the specified monitoring period.

- Receiving Your Personalized Rate: After the monitoring period, Progressive will use the collected data to calculate your personalized discount (or surcharge) and apply it to your policy.

It's important to remember that your participation in the Snapshot program is expressly conditioned on your acceptance of these terms and conditions. Always review these terms carefully to understand data usage, monitoring duration, and potential rate adjustments. You can log in to make updates anytime to your account or view your driving data.

Real-World Experiences with Progressive Snapshot

While the technical details and potential discounts are important, understanding real-world experiences can provide a more nuanced view of Progressive Snapshot. As mentioned in the data, some users have found the beeps from the Snapshot device to be "terrible." One driver recounted, "Got to the point that every single time I would stop at highway speeds if I caught a red light (a perfectly safe action) I would tense up in anticipation of that ridiculous beeps." This highlights a significant user experience factor: the intrusive nature of the feedback can cause stress, even for safe drivers.

Conversely, many drivers report positive experiences, successfully achieving the promised discounts. The ability to check your data through a mobile app or the Progressive website is a frequently praised feature, allowing drivers to see how their habits translate into scores and potential savings. For those who are genuinely safe and consistent drivers, the program often delivers on its promise of lower premiums.

The "Progressive Snapshot review 2025" indicates ongoing relevance and interest in the program. As telematics technology advances, so too will the sophistication of these programs. While the core principles of rewarding safe driving remain, future iterations may offer even more precise tracking or less intrusive feedback methods. The key takeaway from user experiences is that while the savings can be real, the personal tolerance for monitoring and feedback varies greatly. It's a program that rewards you for good driving by personalizing your car insurance rate based on your actual driving, but it demands a certain level of commitment and adaptation from the driver.

In conclusion, Progressive Snapshot offers a compelling pathway to potentially reduce your car insurance premiums by aligning your rates with your actual driving behavior. It's a program that rewards you for driving less, in safer ways, and during safer times of day, leveraging telematics to personalize your discount. While the potential for savings (up to 20%) is a significant draw, it's crucial to acknowledge the risks, including the possibility of a rate increase for poor driving and the sometimes intrusive nature of the monitoring feedback.

Before enrolling, we strongly recommend you read our Progressive Snapshot review to learn how the program works in detail, compare it with other safe driving discount programs, and carefully consider your own driving habits and comfort level with continuous monitoring. If you're a consistently safe and mindful driver, willing to adapt slightly to the program's metrics, Progressive Snapshot could be an excellent tool to unlock substantial savings on your car insurance. Are you ready to see if your good driving could save you extra money? Visit Progressive's website today to learn more about Snapshot in your state and get a personalized quote!

Progressive Snapshot by Brian Mitchell at Coroflot.com

What Every Driver Needs to Know about Progressive Snapshot - Joe Manna

Progressive Snapshot Tips And Tricks at Cynthia Jasmin blog