Navigating Your Drive: In-Depth Auto Insurance & Digital Policy Management

In today's fast-paced world, understanding and managing your auto insurance is more crucial than ever. From the moment you get behind the wheel, you're embarking on a journey that carries inherent risks, making robust protection not just a legal requirement in most states, but a fundamental safeguard for your financial well-being. This comprehensive guide will delve deep into the nuances of car insurance, focusing on how modern providers are making it easier than ever to secure and manage your policy, ensuring you're well-covered no matter where your journey takes you.

Whether you're cruising down the highway, heading to a local drive-in movie theater, or simply parking your vehicle, the right insurance coverage provides peace of mind. We'll explore the benefits of progressive auto insurance options, the unparalleled convenience of online policy management, and the diverse ways you can connect with your insurer. Prepare to gain insights that will empower you to make informed decisions about your vehicle's protection, ensuring you're always ready for what the road ahead holds.

Table of Contents

- The Essential Role of Auto Insurance in Your Daily Drive

- Unlocking Affordability: Discounts and Tailored Coverage for Your Drive

- Seamless Digital Management: Your Policy at Your Fingertips

- Connecting with Your Insurer: Diverse Channels for Every Preference

- Beyond the Basics: Exploring Comprehensive Insurance Options for Your Family's Needs

- Finding Local Expertise: Agents Near Your Drive

- The Drive-In Experience: Protecting Your Vehicle for Leisure and Life

- Securing Your Digital Assets: Parallels with Cloud Storage for Your Important Documents

The Essential Role of Auto Insurance in Your Daily Drive

Car insurance isn't just another bill; it's a critical financial shield designed to protect you from potentially devastating costs following an accident. In nearly every state, it's a legal mandate, a testament to its importance in maintaining order and accountability on our roads. Imagine the scenario: you're involved in a collision. Without adequate insurance, you could be personally liable for vehicle repairs, medical expenses for injured parties, and even legal fees. These costs can quickly escalate into tens or even hundreds of thousands of dollars, far exceeding the average person's savings.

A robust auto insurance policy mitigates these risks by covering damages and liabilities up to your policy limits. This financial protection allows you to focus on recovery rather than bankruptcy. Furthermore, it ensures that if you cause an accident, the other party receives compensation, preventing potential lawsuits against you. For anyone who owns or operates a vehicle, understanding the fundamental role of insurance is the first step towards responsible driving. It's about protecting yourself, your passengers, other drivers, and your assets, making every drive in your vehicle

$DRV

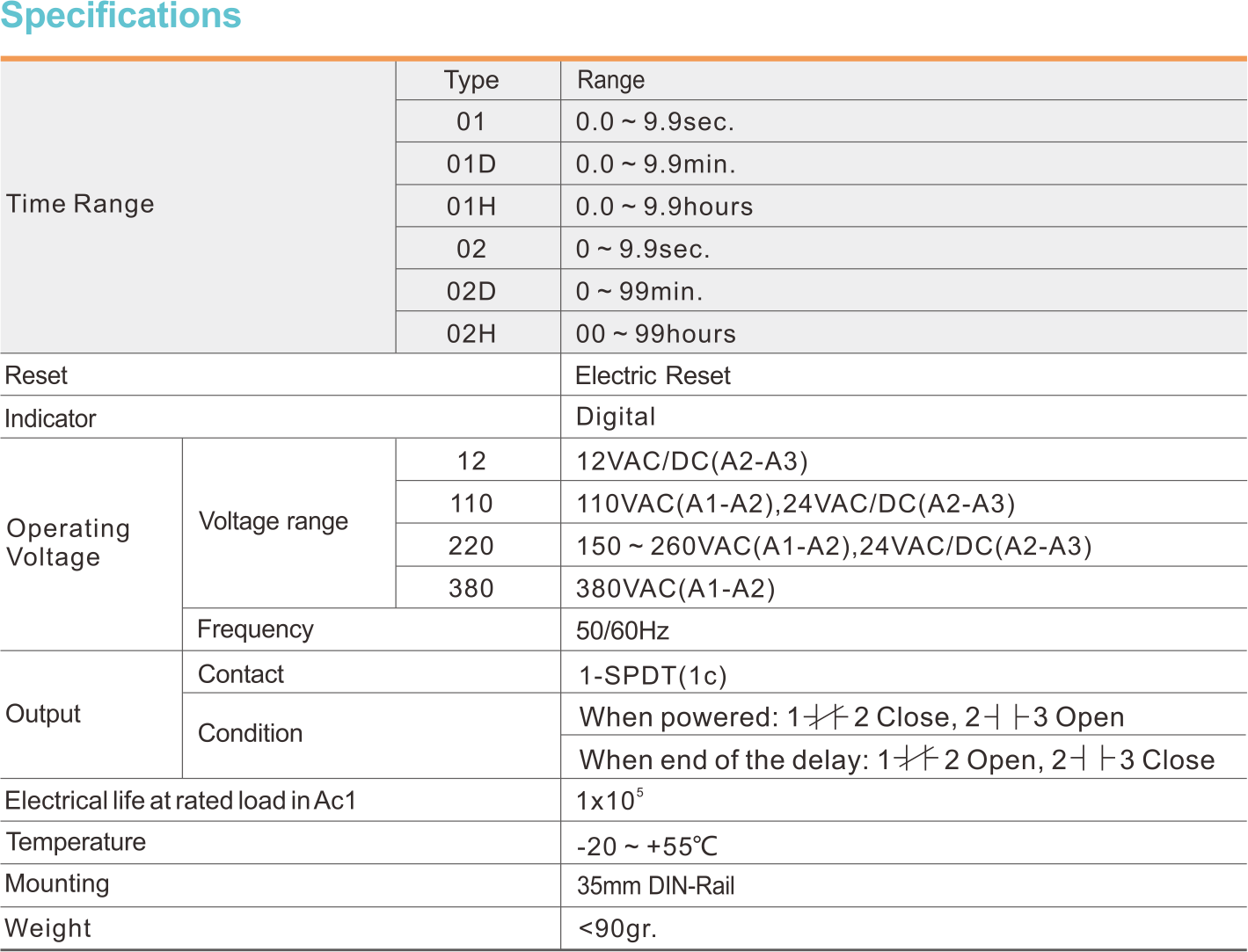

DRV-02 (On Delay) - Buy Digital Time Relay, Digital Timer, Digital

DRV Quality - DRV Suites